- FX Rocket Profits' Newsletter

- Posts

- Trading Edge: Inflation Trends, Oil Dynamics & Market Rundown

Trading Edge: Inflation Trends, Oil Dynamics & Market Rundown

Inflation, Oil & Market Context

This edition highlights how macroeconomic data and geopolitical developments shape trading opportunities. The daily forex and financial market recap provides a snapshot of recent moves, anchoring traders in current sentiment. The Australian inflation cooling to 3.4% in November shows how moderating price pressures can support the AUD, reminding us of the delicate balance between inflation trends and currency strength. Meanwhile, the U.S.–Venezuela conflict explainer reveals why oil prices have remained steady despite political tensions, underscoring the importance of supply dynamics and market expectations. Together, these insights emphasize that successful trading requires blending daily context, economic fundamentals, and geopolitical awareness.

⚡Daily Forex & Financial Market News Recap – Jan 6, 2026

Market Overview: Catch up on the latest moves across forex and financial markets.

Strategic Insight: Use the recap to align your trading with current sentiment.

🔥Headline: Australian Inflation Cooled to 3.4% in November – AUD Supported

Macro Focus: Review how cooling inflation impacts AUD performance.

Trade Scenarios: Consider implications for RBA policy and AUD positioning.

📊Explainer: Why the U.S.–Venezuela Conflict Isn’t Moving Oil Prices Yet

Energy Insight: Understand why oil prices remain steady despite geopolitical tensions.

Market Impact: Explore supply dynamics and investor expectations shaping crude markets.

This curated set of articles blends daily market context, inflation trends, and geopolitical analysis. Whether you’re catching up on recent moves, assessing AUD’s inflation‑driven support, or exploring why oil prices remain steady amid conflict, these reads provide a toolkit for informed trading. Use them to refine your strategy, balance fundamentals with sentiment, and trade with confidence.

Happy Trading!

Amazon Prime members: See what you could get, no strings attached

If you spend a good amount on Amazon, do not ignore this. This card could put $100s back every year and gives you the chance to earn cash back on the purchases you already make. You could get approved extremely fast and unlock a massive welcome bonus instantly. Amazon Prime members: See what you could get, no strings attached

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

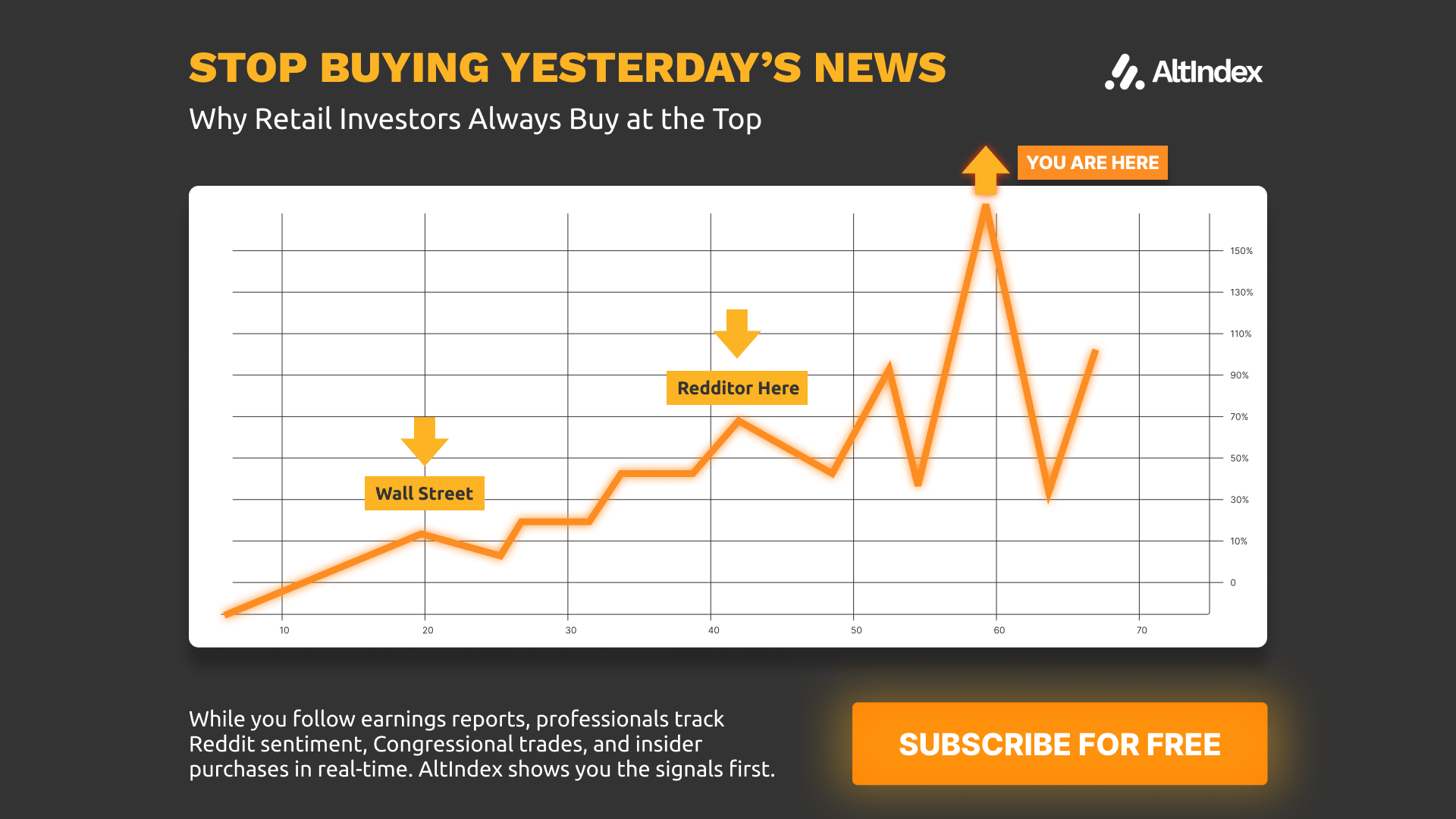

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Trusted by millions. Actually enjoyed by them too.

Morning Brew makes business news something you’ll actually look forward to — which is why over 4 million people read it every day.

Sure, the Brew’s take on the news is witty and sharp. But the games? Addictive. You might come for the crosswords and quizzes, but you’ll leave knowing the stories shaping your career and life.

Try Morning Brew’s newsletter for free — and join millions who keep up with the news because they want to, not because they have to.