- FX Rocket Profits' Newsletter

- Posts

- Macro Watch: Dollar’s Path, Manufacturing Strain & Market Rundown

Macro Watch: Dollar’s Path, Manufacturing Strain & Market Rundown

Macro Signals & Dollar Outlook

This edition highlights how macroeconomic data and currency outlooks shape trading decisions. The daily forex and financial market recap provides a snapshot of recent moves, helping traders anchor their strategies in current sentiment. The USD January 2026 outlook explores how the dollar may perform amid shifting fundamentals, offering context for positioning in major pairs. Finally, the ISM manufacturing PMI headline showing deeper contraction in December 2025 underscores the challenges facing the U.S. economy and its potential impact on risk appetite. Together, these insights emphasize the importance of blending daily context, forward‑looking analysis, and key data releases when navigating markets.

⚡Daily Forex & Financial Market News Recap – Jan 5, 2026

Market Overview: Catch up on the latest moves across forex and financial markets.

Strategic Insight: Use the recap to align your trading with current sentiment.

🔥Explainer: USD January 2026 Outlook

Currency Focus: Explore the dollar’s outlook for January 2026.

Trade Scenarios: Consider how fundamentals may drive USD performance.

📊Headline: US ISM Manufacturing PMI – Deeper Contraction in Dec 2025

Macro Data: Review the latest ISM manufacturing PMI showing deeper contraction.

Market Impact: Assess implications for U.S. growth and risk sentiment.

This curated set of articles blends daily market context, forward‑looking currency analysis, and key macro data. Whether you’re catching up on recent moves, positioning around the USD outlook, or digesting the ISM contraction, these reads provide a toolkit for informed trading. Use them to refine your strategy, balance fundamentals with sentiment, and trade with confidence.

Happy Trading!

You could be wasting hundreds on car insurance

If your auto insurance rate went up in the last 12 months, check this before paying your next bill! All you have to do is enter your zip code and car info to find better insurance options. You could save up to $600 per year!

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

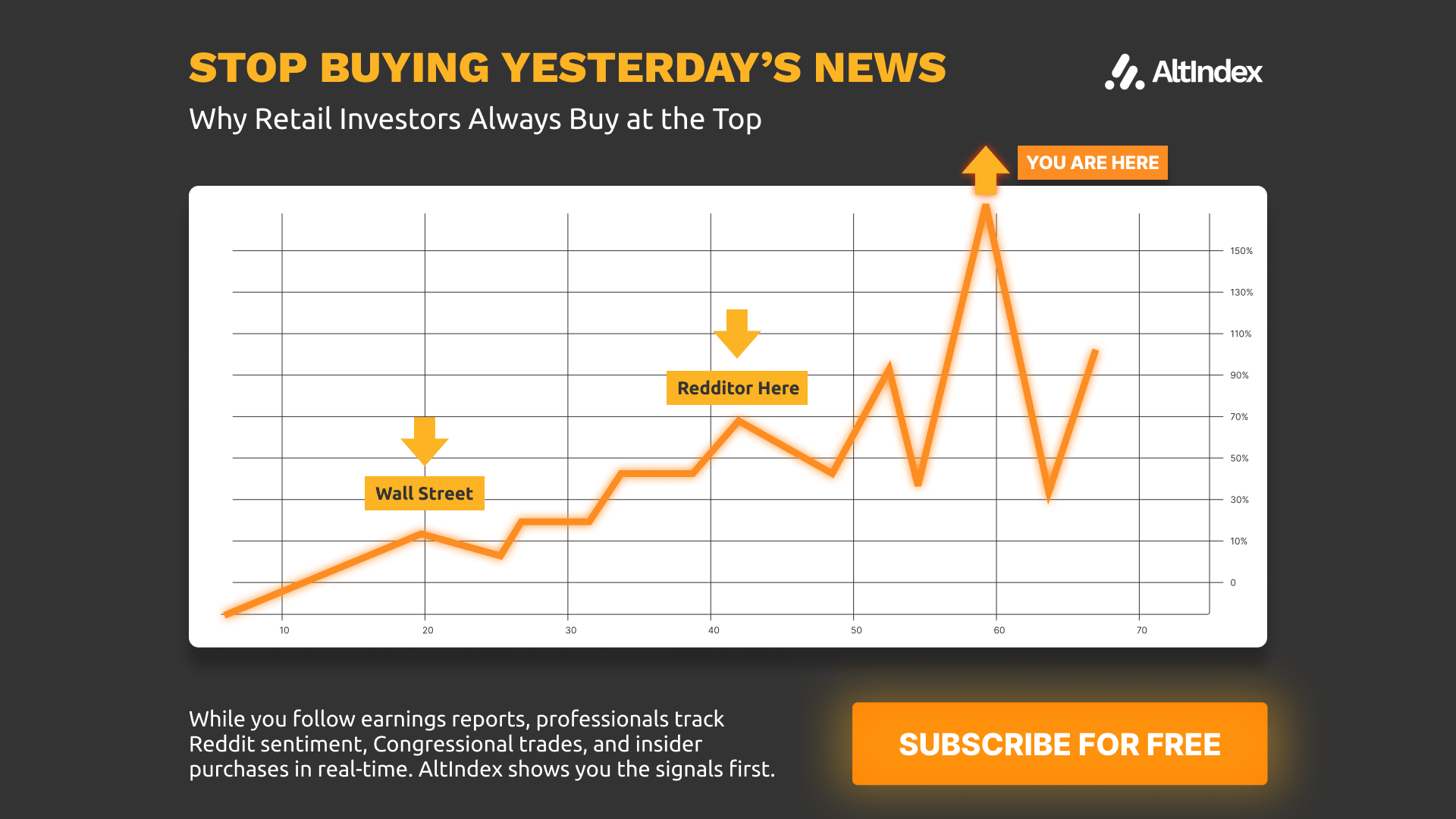

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.